Sorting through Medigap plans can be a challenge if you shop on your own. There are many choices available, but how do you know which one is right for your needs? Medicare Supplement Plan N can be a good choice for those looking for near-comprehensive coverage. Below, we discuss Medicare Supplement Plan N’s main features and benefits.

What is Medicare Plan N and How does Plan N work?

Medicare Plan N is coverage that helps pay for the out-of-pocket expenses not covered by Medicare Parts A and B. It has near-comprehensive benefits similar to Medigap Plans C and F (which are not available to new enrollees), but Medicare Plan N has lower premiums. This makes it an attractive option to many people. If you are interested in enrolling in Medicare Supplement Plan N, or any type of Medigap plan, there are a few things you should know beforehand:

- You must be enrolled in Medicare Parts A & B.

- You can have a Medicare Advantage plan or a Medigap policy, but not both. You can apply for a Medigap policy if you currently have Medicare Advantage, but you must cancel the Medicare Advantage plan before your new Medigap policy begins.

- A Medigap policy only covers one individual. Therefore, your spouse will need to purchase a separate policy.

- Medigap policies are guaranteed renewable even if you have health problems. Your Medigap policy cannot be cancelled as long as you continue to pay your premiums.

- Medigap policies, including Medicare Plan N, do not cover everything. Medicare Plan N typically excludes long-term care, vision or dental care, hearing aids, private-duty nursing, and most importantly, prescription drugs. If you need prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D).

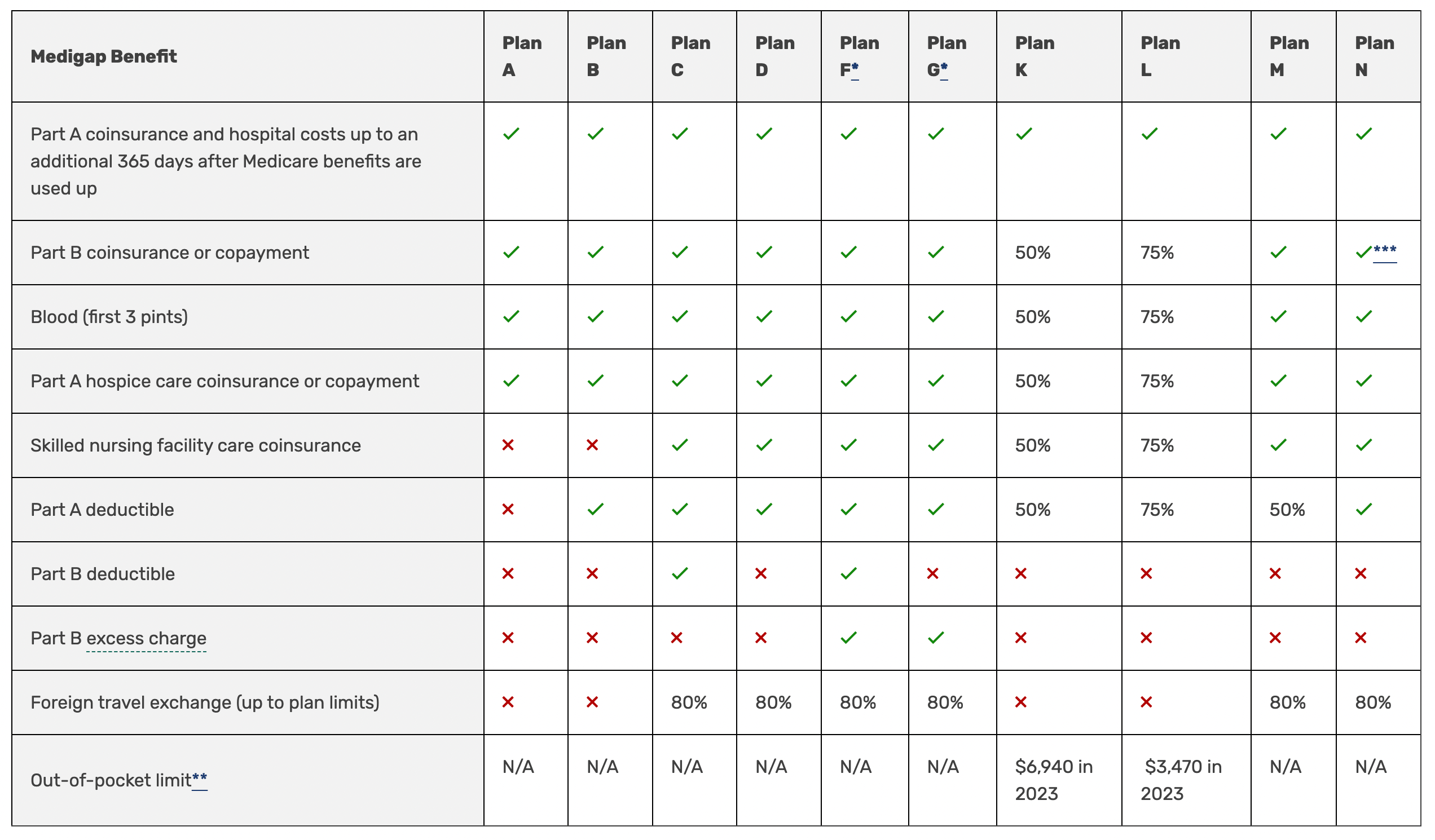

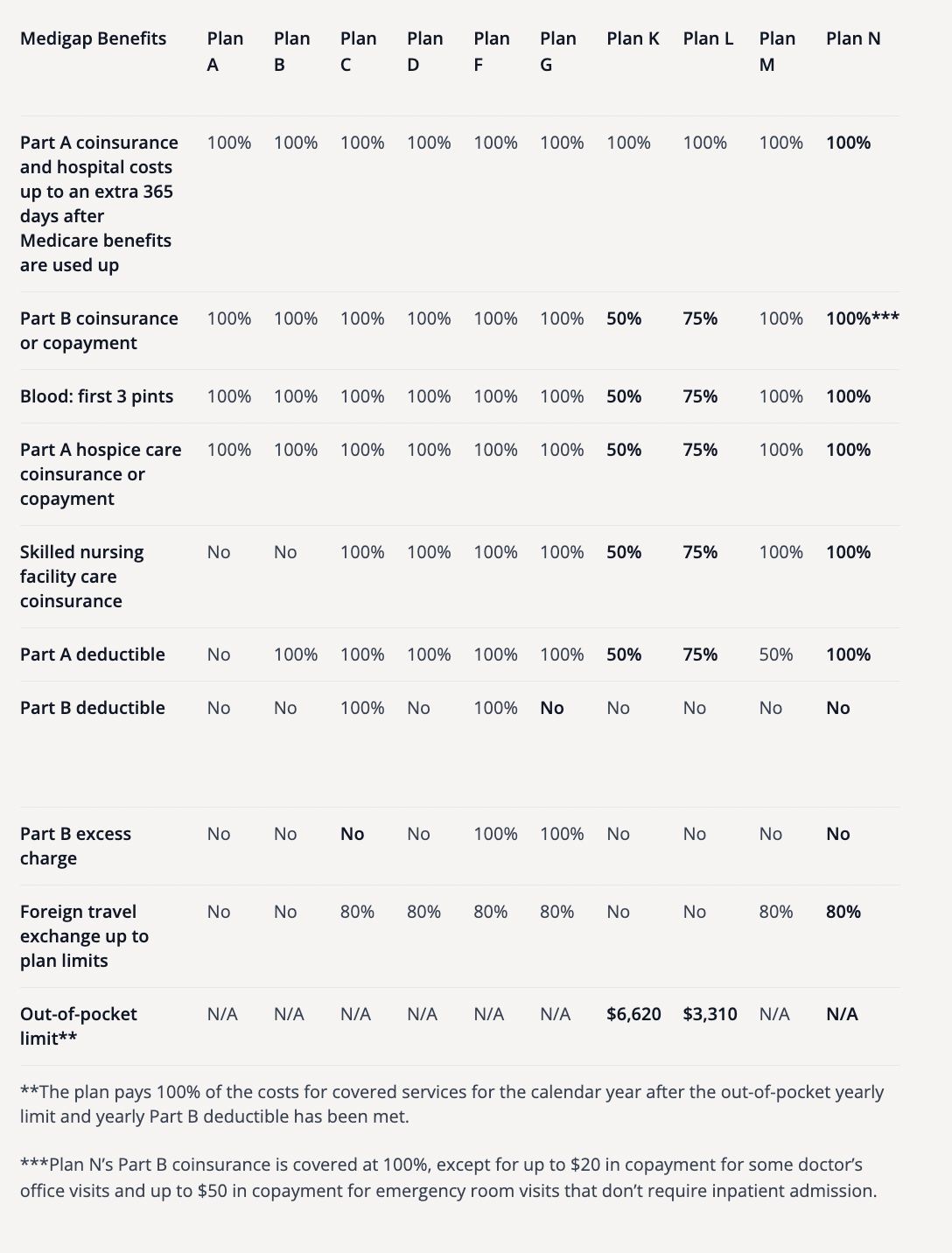

How Does Medigap Plan N Compare with other Medicare Supplement insurance plans

Medicare Supplement Plan N provides more coverage than Plans K and L. For example, it covers 100% of the Medicare Part B coinsurance and copayments, whereas K and L only pay 50% and 75%, respectively. The same is true with the Medicare Part A deductible.

Additionally, the only out-of-pocket expenses beyond the monthly premium are a $20 copay for office visits and a $50 copay for a trip to the ER.

The chart below will help you make comparisons:

A Brief Review of Medicare Supplement Plans

When you turn 65, you’re eligible to enroll in Medicare, a federally facilitated health insurance program. Original Medicare (Parts A and B) will cover some, but not all, of your medical expenses. The portion not covered is often referred to as a “gap.” Medicare Supplement plans, also called Medigap plans, are policies sold by private insurance companies to help pay for the expenses Medicare does not cover.

Medigap plans are standardized by the federal government. This means that plans of the same letter offer the same benefits, no matter who you buy it from. But keep in mind that insurance companies are allowed to offer additional benefits, so compare plans carefully before you purchase a policy. You are eligible to purchase a Medicare supplement insurance plan if you are 65 years old or older and enrolled in Medicare Part B. If you are under 65 and disabled, you will likely be limited as to which Medigap plan you can purchase.

There are 10 Medigap plan options in total. But we are going to focus on Medicare Supplement Plan N.

Medicare Supplement Plan N Benefits

Medigap Plan N has coverage for four basic areas:

- Hospitalization: pays Part A coinsurance and provides coverage for 365 additional days after Medicare benefits end.

- Medical Expenses: pays Part B coinsurance (excluding copays for office visits and ER) and 20% of Medicare-approved expenses or copayments for hospital outpatient services.

- Blood: pays the first three pints of blood annually. Original Medicare pays for any pints beyond 3.

- Hospice Care: pays Part A coinsurance.

Additionally, Medicare Supplement Plan N pays for skilled nursing facility care and the Medicare Part A deductible for hospitalization.

Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctor’s office and emergency room visits.

How do supplemental policies work for Medicare?

Medicare Supplement insurance plans help pay for costs not covered by Original Medicare. Each plan provides a range of benefits so you can choose the best Medigap plan for your needs.

Basic benefits:

- Part A coinsurance and hospital costs up to an additional 365 extra days after Medicare benefits are used

- Part B coinsurance or copayment

- Blood (first 3 pints)

- Part A hospice care coinsurance or copayment

Additional benefits that may be included in certain plans:

- Skilled nursing facility care coinsurance

- Part A deductible

- Part B deductible

- Part B excess charge

- Foreign travel exchange (up to plan limits)

- Out-of-pocket limit

Medigap Plan N Outline of Coverage Chart for 2023

What Does Medicare Supplement Plan N Cover?

Medigap Plan N has coverage for four basic areas:

- Hospitalization: pays Part A coinsurance and provides coverage for 365 additional days after Medicare benefits end.

- Medical Expenses: pays Part B coinsurance (excluding copays for office visits and ER) and 20% of Medicare-approved expenses or copayments for hospital outpatient services.

- Blood: pays the first three pints of blood annually. Original Medicare pays for any pints beyond 3.

- Hospice Care: pays Part A coinsurance.

Additionally, Medicare Supplement Plan N pays for skilled nursing facility care and the Medicare Part A deductible for hospitalization.

Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctor’s office and emergency room visits.

Enrollment for Medigap Plan N

Enrollment begins the first day of the month you turn 65 and are covered under Medicare Part B and ends six months after your birthday month. Applying for benefits during this time is the most beneficial, as insurance companies are not permitted to use medical underwriting. That means you could get the lowest prices available.

Applying for benefits outside of the six-month time window could mean higher premiums or a denial of coverage due to your health.

What is High-deductible Plan G and how is it a low-cost alternative?

High Deductible Plan G works very similarly to other Medigap plans. Like other Medigap options, the plan works with regular Medicare Part A and B and fills in the gaps in Medicare. There are no networks on HDG or any other Medigap plans – you can use the plan at any doctor or hospital that accepts Medicare.

High deductible Plan G has a deductible of $2700 (for 2023 – this deductible changes each year). What this means is that, when you use medical services, Medicare will pay their 80%, and you will be responsible for the other 20% until you meet the $2700 deductible. In other words, you will pay 20% of Medicare-approved charges up to $2700 per calendar year.

After you have paid out $2370 in a calendar year, your HDG plan will act exactly like a “regular” Plan G. The plan will pay what Medicare does not pay (the 20%). HDG, like standard Plan G, does not cover the Medicare Part B deductible ($226/year in 2023); however, that deductible goes towards the larger HDG deductible so you would have already met it by the time you reach the $2700 HDG deductible.

The deductible for HDG resets each calendar year, so you would have to start over with meeting the deductible each year. High deductible Plan G, just like any other Medigap plan, can never be cancelled for reasons other than non-payment of premium. The plan is ‘guaranteed renewable’ and does not have to be renewed annually, nor does it have any sort of annual renewal period.

How Much Does a Medigap Plan N Cost?

The premiums associated with Medicare Supplement plans differ by location and insurance company. As a general reference, in 2021, a non-smoking 65-year-old woman living in Florida’s 32162 ZIP code would pay between $124 and $182 for Medicare Supplement Plan N monthly premiums.1

But how do companies set these prices? They use one of three price rating systems to set premiums:

- Community-rated: everyone with the policy pays the same price regardless of age. Pricing can still change based on inflation but cannot increase due to your age.

- Issue-age-rated: the premium is based on the age you are at the time of purchase. Therefore, it costs less for people who buy at a younger age. The price cannot increase after the issue date due to age.

- Attained-age-rated: the premium starts low and increases as you age.

There can be a wide variance in cost. Differences may exist based on whether or not the insurance company selling the policy offers discounts or uses medical underwriting.

Pro Tip: When shopping for a Medicare Supplement policy, always compare apples to apples. You want to be make certain you are comparing a Medigap Plan N from one company to a Medicare Plan N from another company. You don’t want to compare Plan N at one company to Plan B at another because you won’t get a clear comparison between the prices and benefits.

How Do I Enroll in a Medigap Plan N?

Enrollment begins the first day of the month you turn 65 and are covered under Medicare Part B and ends six months after your birthday month. Applying for benefits during this time is the most beneficial, as insurance companies are not permitted to use medical underwriting. That means you could get the lowest prices available.

Applying for benefits outside of the six-month time window could mean higher premiums or a denial of coverage due to your health.

Is Medicare Supplement Plan N Better than Medicare Advantage?

Medicare Supplement Plan N provides more coverage than Plans K and L. For example, it covers 100% of the Medicare Part B coinsurance and copayments, whereas K and L only pay 50% and 75%, respectively. The same is true with the Medicare Part A deductible.

Additionally, the only out-of-pocket expenses beyond the monthly premium are a $20 copay for office visits and a $50 copay for a trip to the ER.

Should I know anything else before enrolling in Medicare Plan N?

If you are interested in enrolling in Medicare Supplement Plan N, or any Medigap plan, there are five things you should know beforehand:

- You must be enrolled in Medicare Parts A & B.

- You can have a Medicare Advantage plan or a Medigap policy, but not both. You can apply for a Medigap policy if you currently have Medicare Advantage, but you must cancel the Medicare Advantage plan before your new Medigap policy begins.

- A Medigap policy only covers one individual. Therefore, your spouse will need to purchase a separate policy.

- Medigap policies are guaranteed renewable even if you have health problems. Your Medigap policy cannot be cancelled as long as you continue to pay your premiums.

- Medigap policies, including Medicare Plan N, do not cover everything. Medicare Plan N typically excludes long-term care, vision or dental care, hearing aids, private-duty nursing, and most importantly, prescription drugs. If you need prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D).

Ready to enroll in Medicare Plan N or have more questions regarding your Medicare Policy? Give us a call! Our expert agents are ready and waiting to help! Call us today at (561) 637-8162 or email us at estinsurance@gmail.com.