HMO, PPO or EPO — Which plan is right for you?

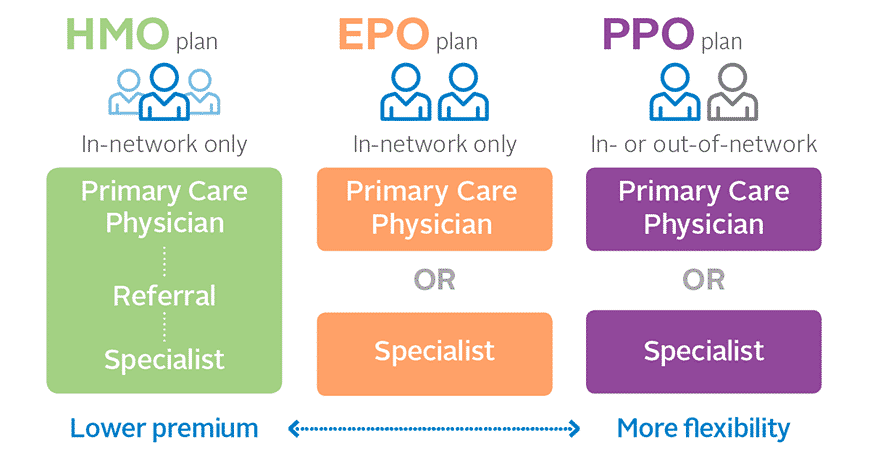

As if medical insurance in Florida couldn’t get any more complicated, there are three different types of plans to choose from — EPO, HMO, & PPO. The question is, which one is the right plan for you?

Health Maintenance Organization (HMO): A Budget-Friendly Plan

HMO (Health Maintenance Organization) individual plans are another type of health insurance plan available in Florida for individuals seeking coverage. These plans typically have lower monthly premiums compared to PPO (Preferred Provider Organization) plans, but offer less flexibility in terms of choosing a healthcare provider.

Under an HMO plan, policyholders are typically required to choose a primary care doctor (primary care provider) who acts as their main point of contact for all medical needs. This doctor(primary care physician pcp) will then refer the policyholder to specialists or other healthcare providers as needed.

Most HMO’s require referrals to seek care for out of network doctors and hospitals.

HMO plans have a limited network of healthcare providers, and policyholders may have to pay full cost for services received outside of this network.

The only time you can seek healthcare for out of for out of network benefits is for emergency care. On most ACA Health Plan types this would be considered “in-network.”

Because of how limited some hmo’s network can be its advised for individual to only see in network providers. In network care for medical expenses in the HMO network will cost less money and have less out of pocket costs than either PPO, EPO. Traditionally HMO’s(Health Maintenance Organizations) do not have out of network coverage/out of network care.

HMO plans are often more affordable than PPO plans and can be a good option for those who are looking for low-cost health insurance and are willing to sacrifice some flexibility in exchange. If you need to see a specialist make sure the doctors are in network. If you have quality standards in terms of doctors, hospitals or don’t want to deal with an out of network provider we recommend either an PPO, EPO.

Pros and Cons of HMO Insurance

Pros

- Affordability: HMO insurance plans typically come with lower out-of-pocket expenses, including lower premiums, low or possibly no deductibles, and reduced co-pays. This makes HMOs a cost-effective choice for many individuals and families.

- Coordinated Care: In HMOs, your primary care physician oversees your treatment and advocates on your behalf. This creates a more personalized and efficient healthcare experience.

- Quality of Care: HMOs secure a network of healthcare providers, including primary care physicians, specialists, and clinical facilities. These providers are contractually committed to delivering a range of medical services, contributing to a higher standard of care for HMO members.

Cons

- Network Restrictions: One of the main limitations of HMOs is that you must receive care from healthcare providers within the plan’s network. You may have to bear the cost if you see a health care provider outside of this network.

- Need for Referrals: You can’t directly visit a specialist under an HMO insurance plan. A referral from your primary care physician is required, which might delay the process depending on the urgency of your condition.

- Emergency Coverage Conditions: While HMOs generally cover emergencies even if they occur out-of-network, certain conditions must be met for the plan to pay. This means not all emergencies may be covered, and the definition of “emergency” can vary across different HMO insurance plans.

Preferred Provider Organization (PPO): The Plan with the Most Freedom

PPO (Preferred Provider Organization) individual plans are a type of health ins option available in Florida for individuals who are seeking coverage. These plans typically provide more flexibility in terms of choosing a healthcare providers/health services compared to HMO (Health Maintenance Organization) plans. Under a PPO health plan, policyholders can visit any healthcare provider they choose, but may pay more out of pocket for visits to out-of-network providers. Comparing an EPO vs PPO you will find the PPO plan has higher premiums.

Additionally, PPO plans usually have a network of preferred providers who offer services at a discounted rate to policyholders. These plans also typically offer more comprehensive coverage options, such as coverage for prescription drugs and mental health services. You do not need a referral from a primary care physician to see a specialist with a PPO plan.

In general you will find the PPO’s network to be larger than either an HMO or EPO. This includes a POS plans. If you travel and have specialists and doctors in many states a PPO plan would make most sense.

Overall, PPO individual plans can be a good option for those who value flexibility and comprehensive coverage in their insurance. If you are worried about out of pocket costs or out of network services a PPO would be best for you. A PPO allows for more freedom and a larger network.

An example of a PPO health plan here in Florida would be Blue Blue/Blue Shield Blue Options.

Pros and Cons of PPO Insurance

Pros

- Freedom of Choice: PPO insurance plans offer a larger network of doctors and hospitals, giving you more options for where to receive care. Unlike some other insurance types, you’re not required to commit to a single primary care physician, which can be particularly beneficial if you frequently travel or wish to see different doctors.

- No Referrals Needed: With a PPO insurance plan, you can visit a specialist without needing a referral from a primary care physician. This can save you both time and the cost of an additional appointment, getting you the specialized care you need faster.

- Out-of-Network Availability: While seeking care within your network is recommended, PPO insurance plans partially cover care accessed outside of your network. You may have to pay more out-of-pocket costs than if you had used a preferred provider, but this provides more flexibility than plans that only cover in-network care.

Cons

- Higher Monthly Premium Costs: PPO insurance plans generally have higher costs than others. The premiums are typically higher, and you’ll also need to meet an annual deductible before your insurance company begins to cover costs. Plus, if you visit an out-of-network provider, you’ll have to pay more out-of-pocket prices.

- Deductible Costs: With a PPO insurance plan, you’ll have an annual deductible representing the money you’ll have to pay out of pocket before your insurance covers anything. Deductibles can vary but add an extra cost consideration when choosing a PPO plan.

- Filing Claims: When you visit a network doctor, hospital, or specialist, your medical care professional usually files your claim paperwork on your behalf. However, you must file the claim documentation yourself if you receive out-of-network care. This process can be tricky or confusing, particularly if you have several doctor visits or are treating a chronic medical issue.

Exclusive Provider Organization (EPO): Larger Networks to Make Life Easier

EPO (Exclusive Provider Organization) individual plans are a type of health insurance plan available in Florida for individuals seeking coverage. EPO plans offer a compromise between the flexibility of PPO plans and the cost savings of HMO plans. Unlike PPO plans, EPO plans have a limited network of healthcare providers that policyholders are required to use in order to receive coverage.

Compared to HMO plans, EPO(Exclusive Provider Organizations) plans offer more flexibility as policyholders do not need a referral from a primary care physician to see a specialist. Remember you still need to stay in-network for doctors and a specialist.

Additionally, while policyholders will typically pay more out of pocket for visits to providers outside of the EPO plan/network, they may still have more options than they would under an HMO plan. Overall, an EPO plans can be a good option for those who are looking for a balance between the cost savings of an HMO and the flexibility of a PPO in their health plan.

An example of an insurance company in Florida that offers an EPO plan would be Cigna.

Cigna EPO health plans do not have out of network benefits. But because its an EPO plan you do not need a referral from your primary care physician.

Pros and Cons of EPO Insurance

Pros

- Cost-Effective Premiums: One of the principal benefits of EPO insurance plans is their relatively affordable monthly premiums, making them an appealing choice for individuals who want to manage their healthcare costs.

- Broad Provider Network: EPOs usually have an extensive selection of medical care providers, offering patients more options than other types of plans, like HMOs.

- Elimination of Primary Care Gatekeepers: Some EPO insurance plans allow patients direct access to specialists, removing the need for referrals from a primary care physician. This can expedite the process of receiving specialized care.

Cons

- Higher Out-of-Pocket Expenses: While EPOs offer lower premiums, they often come with higher deductibles, meaning patients could pay more out-of-pocket before the insurance coverage kicks in.

- Limited Out-of-Network Coverage: EPO insurance plans typically do not cover services provided by out-of-network health care providers. Therefore, if a preferred provider is outside the EPO’s network, the patient may have to bear the full cost of medical services.

- Geographic Limitations: The provider networks of EPO insurance plans may be geographically restricted, which can disadvantage those who travel frequently or live in rural areas with limited in-network providers.

What network should you pick?

Choosing the right network – HMO, EPO, or PPO – depends on several factors unique to your situation, needs, and preferences. Here are some considerations to guide your choice:

- Budget: If keeping your premiums and out-of-pocket costs low is your top priority, an HMO may be the right choice for you. They typically have lower premiums and copays, although they also require referrals and generally don’t cover care outside the network.

- Healthcare Needs: If you frequently need specialized care or have a condition that requires regular visits to different healthcare providers, a PPO might be a better fit. PPOs offer more flexibility in choosing providers and don’t require referrals to see specialists. However, they’re usually more expensive.

- Flexibility: If you value the freedom to see specialists without a referral but don’t mind staying within a specified network, an EPO could be a good middle ground. EPOs don’t require referrals like HMOs do, but they only cover care within their network (unless it’s an emergency).

- Provider Preferences: If you already have preferred doctors or specialists, check to see if they are in the network for the plan you’re considering. If your preferred providers are out-of-network, you may want to consider a PPO, which allows for out-of-network care.

- Risk Tolerance: If you’re willing to pay a higher premium for the peace of mind that comes with extensive coverage and flexibility, a PPO might be worth the cost. If you’re generally healthy and willing to work within a more restrictive network to save on costs, an HMO or EPO might suit you better.

The health insurance marketplace has a myriad of health plans that are HMO, EPO and PPO. You wll have higher costs for the EPO and PPO plans. In Florida, Florida Blue Options has the highest costs for a PPO. HMO Plan types Aetna, Ambetter, Molina and Florida Blue HMO will have lower costs than an EPO or PPO plan. Cigna is our pick for top EPO plan in 2023.

HMO, EPO, and PPO FAQ

Do I need a referral to see a specialist with an HMO, EPO, or PPO?

With an HMO, you typically need a referral from your primary care doctor to see a specialist. However, EPO and PPO plans generally do not require referrals, allowing you to see specialists within their respective networks directly.

What’s the difference between in-network coverage and out-of-network coverage?

“In-network” and “out-of-network” coverage refers to whether a healthcare provider has a contractual agreement with your health insurance program. If a provider is “in-network,” they have agreed to a negotiated rate with your insurance company, which typically means lower costs for you. The insurer covers more of your medical costs when you visit an in-network provider. Conversely, “out-of-network” providers do not have such agreements with your insurance company. As a result, if you seek care from out-of-network providers, your out-of-pocket expenses are typically higher, and your insurer may cover less or none of the cost, depending on your specific insurance plan.

Will I have coverage if I see a healthcare provider outside of my plan’s network?

For an HMO or EPO, generally, you won’t have coverage if you see a provider outside of the network, except in the case of an emergency. With a PPO, you still have coverage if you see an out-of-network provider, but your out-of-pocket feeswill be higher.

Which plan typically has the lowest out-of-pocket costs?

HMO plans usually have lower out-of-pocket costs compared to EPO and PPO plans. However, they also need more flexibility in terms of provider choice.

Can I change from one plan to another, like from an HMO to a PPO or EPO?

Yes, you can change your plan in Florida during the annual Open Enrollment Period or during a Special Enrollment Period if you’ve had a qualifying life event, such as marriage, divorce, having a child, or losing other health coverage.

For questions on an EPO vs PPO or about an HMO Health policy please give us a call at 954-282-6891. Our agents are waiting to help you today!

Health Insurance Florida

Trustindex verifies that the original source of the review is Google. Evan was incredibly helpful to me when I had an issue with a previous insurance plan. He was immediately responsive, pulled together the best option for me and my child, took care of the registration and walked me through the next steps. He was very knowledgeable and tailored the plan to my specific scenario.Posted onTrustindex verifies that the original source of the review is Google. Evan was super fantastic to work with. This was my first time setting up my own insurance plan so already I was intimidated by the process but he made it incredibly easy and was there to provide assistance. He is professional and dedicated to getting a plan that works best for you!Posted onTrustindex verifies that the original source of the review is Google. I have been using Florida Healthcare Insurance for 3 years now and each year they are able to get me the best rate for health insurance for the upcoming year!Posted onTrustindex verifies that the original source of the review is Google. It has been a pleasure dealing with Michelle. She asked all the questions that would help her best serve our needs and get us the best plan. I have and will continue to recommend her!Posted onTrustindex verifies that the original source of the review is Google. Florida healthcare insurance and evan are amazing! He responded to my message very promptly and helped me get a plan for my family for 2024 with ease. So thankful for this company!Posted onTrustindex verifies that the original source of the review is Google. Thank you Evan Tunis for providing us with the best health plan !Posted onTrustindex verifies that the original source of the review is Google. I only recently started working with Evan, however he’s been wonderful so far and I’m very grateful! I’ll be sticking with him for as long as I can! Everything was made quick, easy, and simple for me! Which is very appreciated considering I know practically nothing about health insurance, so he’s been really great to me!Posted onTrustindex verifies that the original source of the review is Google. Evan is great! He makes the process of getting insurance painless and always answers any questions I have.Posted onTrustindex verifies that the original source of the review is Google. Great service very helpful