Congratulations you’ve turned 65 and are now eligible for Medigap(Medicare Supplement Insurance). You’ve probably heard of Parts A,B,C, D, F or Parts C, D, F &G but what exactly does this mean when shopping Medigap providers for a Medicare Supplement Insurance plan? With companies such as Blue Cross Blue Shield, Mutual of Omaha, AARP United Healthcare and United American where does one start when comparing the different Medigap plans?

The team at FHI will breakdown the best Medigap Plan (Medicare Supplement) plans and what to look for in your Medigap company. If you are looking for the best medicare supplement plan our guide below will point you towards financial stability.

Years In Market

The first thing we advise our clients in shopping for a Medigap policy is to look at “Years in Market” for the Medicare supplement insurance company. You want a Medicare Supplement insurance company that has been in your area for at least ten years. You’ll want to look for standardized Medicare supplemental insurance companies F, G, K, L & N. The reason to look for insurance companies with greater than ten years of offering medicare plans is simple:

They understand Medicare Claims and thus monthly premiums should remain relatively stable throughout the years.

Examples include carriers such as Blue Cross Blue Shield, Mutual of Omaha, AARP Medigap Plans, Cigna Medigap Plan, and United American Insurance Company. If an insurance company such as Accendo Insurance Company has low monthly premiums but has only been in your area for a year you want to avoid it. That’s not to say they are a bad insurance company.

Unlike Medicare Advantage Plans, a Medicare Supplement Plan is only guaranteed issue when you turn 65 or if you have a Special Election Period. The last thing you need in your golden years is for a Medicare Supplement Insurance Company to initially misprice the monthly premium too low and to have a higher monthly premium as you age.

Market Analytics(Rate Increase History)

All Medigap (Medicare Supplement Insurance companies) will raise your rate from time to time. So when shopping for a Medigap plan you want to ensure that your insurance company offers financial stability and a history of low increases. Evan Tunis owner of Florida Healthcare Insurance,

“Many Medicare beneficiaries will look at Medicare Supplement Plans by name and price alone. This is a mistake. You want insurance companies that offer Medigap policies with an Average Rate Increase of less than 3%. The best Medicare supplement plans are the ones you can afford yearly.”

Finding the Increase History of Medigap insurance companies might be difficult. You may be able to find it on official government websites such as Medicare.Gov. Traditionally, Medicare supplement insurance companies don’t really advertise rate increases. Luckily the team at FHI has the 411 on Medicare Supplement Insurance companies.

Evan Tunis, “When we use our Market Analysis software we can access all Medicare Supplement Plans. This gives us insight into what Medigap policies have had significant increases, financial ratings, additional discounts/additional benefits and who has the highest medicare enrollment.

What is A MediGap Plan?

Medicare supplement plans(Medigap Plans) are offered through private insurance companies and cover the gap that Original Medicare doesn’t cover. Medicare Part A and Medicare Part B cover 80% and your Medigap plan covers the remaining 20%.

Original Medicare is a federal health insurance program that provides basic coverage for those over the age of 65, as well as those with certain disabilities. To help cover the costs not covered by Original Medicare, many individuals opt for a Medicare Supplement Plan, also known as a Medigap plan.

Medigap plans are sold by health insurance companies like Mutual of Omaha and Blue Cross Blue Shield and are designed to fill the gaps in Original Medicare coverage. These plans often come with higher monthly premiums compared to Original Medicare, but provide peace of mind by covering the additional costs not covered by Original Medicare, such as deductibles, coinsurance, and copays.

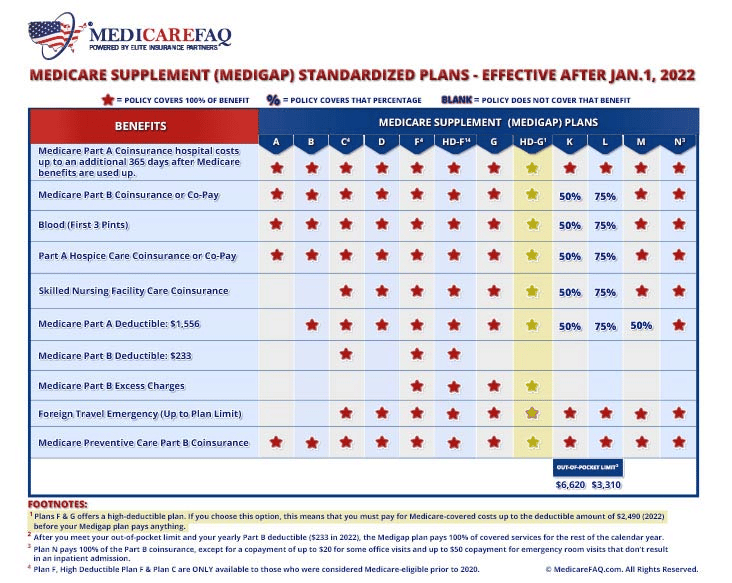

There are several different types of Medigap plans available, each with different levels of coverage and costs. A Medigap policy includes plans F, G, K, L & N. Currently the most popular medicare supplement plan is Medicare Supplement Plan G. Plan G offers the most comprehensive coverage on a Medicare Supplement Plan. Medicare Supplement Plan G covers all the gaps of original medicare except the Part B deductible. For 2023 the Medigap Plan G deductible is $226. For the High-Deductible Plan G, the deductible is 2,700.

It’s important for individuals to carefully consider their health care needs and financial situation when choosing a Medigap plan. They should take into account their current health, as well as their future health care needs, to determine the best plan to meet their needs. Individuals should consult with a licensed insurance agent or Medicare specialist to determine the best Medigap plan options during the Medigap Open Enrollment Period.

About High Deductible Medigap Plans

High deductible plans offer the same great Medigap coverage with lower monthly premiums. Standardized medicare supplement plans offer Plan G. Plans are rated through third-party rating agencies such as AM Best. An A Rating will mean your Health Insurance Medigap Plan is stable. You should only seek medicare coverage from A Rated comprehensive medigap plans.

High Deductible Plan Medigap policies are a variation of the traditional Medigap plans that offer a lower monthly premium in exchange for a higher deductible. With these policies, individuals pay a lower premium each month, but are required to pay a higher deductible before their insurance coverage kicks in.

Insurance companies like Mutual of Omaha and Blue Cross Blue Shield offer High Deductible Plan Medigap policies as an option for individuals who are looking for a more cost-effective way to supplement their Original Medicare coverage. These policies are designed for individuals who are in good health and are willing to pay more out-of-pocket costs in exchange for lower monthly premiums.

It’s important to carefully consider the cost and benefits of High Deductible Plan Medigap policies before enrolling. While they may provide a cost savings in the short term, they may result in higher out-of-pocket costs in the event of a health issue. Individuals should weigh the costs and benefits carefully and consult with a licensed insurance agent or Medicare specialist to determine if a High Deductible Plan Medigap policy is the right choice for their individual needs.

Below is an example of a Medicare Supplement Policy High deductible plan G with Mutual of Omaha. The Mutual of Omaha Medicare Supplement does not have prescription drug coverage.

Medigap Out of Pocket

Your out-of-pocket expenses are significantly less on a Medigap plan compared to a Medicare Advantage Plan. You will have a montly premium however the bill for services will be considerably less than a Medicare Advantage plan. Medicare beneficiaries who enroll in a Medigap Plan will still need to purchase dental and vision coverage, prescription drug coverage, and hearing coverage.

In our opinion Medigap Plan G or Medigap Plan N are the best medicare supplement plans. Medicare Supplement Plan G/N offer comprehensive coverage with high quality and customer satisfaction. Some of the Medicare supplement insurance companies we recommend are Blue Cross Blue Shield, Mutual of Omaha, AARP Medigap plans and United American Insurance company.

Comparing Medigap Plans and Medicare Advantage Plan

Medicare beneficiaries that we work with love Medicare Supplement Plans(Medigap plans) due to their Medicare benefits, ease of paying claims, Medigap Providers and Household Discount. But what are the differences between a Medicare supplement plans(MediGap) and Medicare Advantage?

Medigap plans are designed to help individuals cover the costs of health care services not covered by Original Medicare. There are several different types of Medigap plans available, each with different levels of coverage and costs. On the other hand there is Medicare Advantage.

On the other hand, Medicare Advantage, also known as Medicare Part C, is a type of Medicare health plan offered by private insurance companies that contract with Medicare to provide all the benefits of Original Medicare, and often additional benefits such as vision, hearing, and dental coverage.

With a Medicare Advantage plan, individuals may have lower monthly premiums compared to a Medigap plan, but may have higher out-of-pocket costs, such as copays and deductibles, and may be required to pay coinsurance for certain services.

Both Medicare Advantage and Medigap plans offer different levels of coverage and come with different costs and requirements. It’s important for individuals to carefully consider their health care needs and financial situation when choosing between the two options, as having a plan that covers the right benefits and services is crucial for managing their health care and having insurance companies pay claims for their covered expenses.

In addition to traditional Medicare coverage, individuals may also be eligible for Medicaid options, which can help cover the costs of health care services not covered by Medicare. Some Medicare plans also offer additional benefits, such as dental insurance, to help individuals manage the costs of health care.

When Can I Enroll in a MediGap Plan?

Medigap Initial Open Enrollment is a period when individuals who are 65 years or older and enrolled in Medicare Part B can purchase a Medigap plan without undergoing medical underwriting, and may receive an enrollment discount. These plans often come with higher monthly premiums compared to Original Medicare, but provide peace of mind by covering the additional costs not covered by Original Medicare, such as deductibles, coinsurance, and copays.

During this time, individuals can enroll in a Medigap plan without having to answer questions about their health, and without being turned down for coverage due to pre-existing medical conditions. A Medigap policy includes plans F, G, K, L & N.

There are two important enrollment periods to be aware of when it comes to Medigap coverage:

- Initial Enrollment Period (IEP): This is a seven-month period that begins the month you turn 65 and are enrolled in Medicare Part B. During this time, you can enroll in a Medigap policy without being subject to medical underwriting, which means the insurance company cannot deny you coverage or charge you more due to pre-existing health conditions.

- Open Enrollment Period (OEP): This is an annual enrollment period that lasts from January 1 to March 31, during which anyone enrolled in Medicare Part B can make changes to their existing Medigap policy or enroll in a new one. During this time, insurance companies cannot use medical underwriting to deny coverage or charge higher premiums.

It’s important to note that these enrollment periods only apply to Medigap coverage and not to original Medicare. It’s also important to keep in mind that if you miss your IEP, you may have difficulty enrolling in a Medigap policy or could face higher premiums due to medical underwriting. So pay attention people.

Conclusion

Medigap Plans provide excellent coverage for seniors. Still have questions about Medicare part F, G, K, L or between Medigap and Medicare Advantage Plans? Let the team at FHI help you today. You can contact us at 954-282-6891. We are the experts at Medigap Plans and look forward to helping you today.

More Information: