Florida Healthcare Insurance is proud to offer Medicare Supplement Insurance policies from United American Insurance Company (Globe Life).

If you are considering Medigap Plans then one of the best plan options include United American Insurance to supplement your Original Medicare.

United American Medigap Plans will offer protection from significant out of pocket costs and care when you need it the most.

You can discuss this with us for free, simply contact us HERE.

Let’s take a look at some of the great features you have with United American Insurance ProCare as your Medicare Supplement plan:

You can discuss this with us for free, simply contact us HERE.

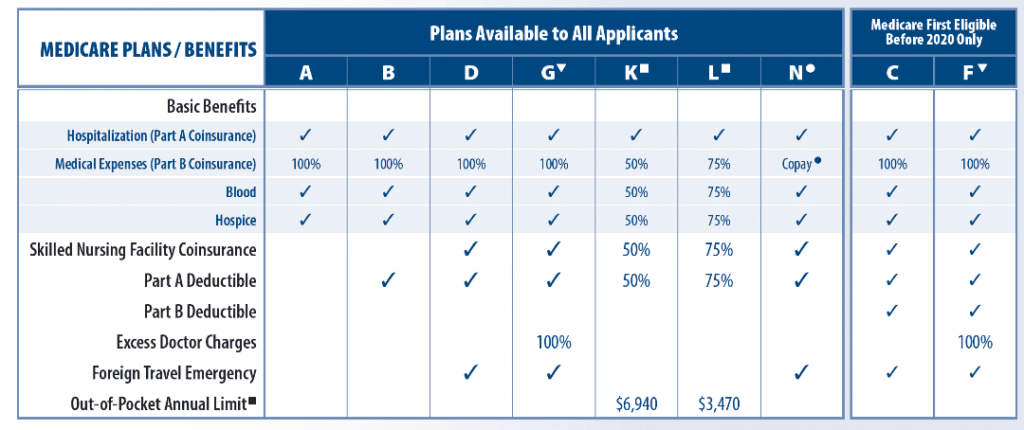

We offer Medicare Supplement policies for 11 of the 12 Medicare Plans, however, for simplicity purposes, Florida Healthcare Insurance focuses mainly on Plans F, G, and N. All of the plans offer the following standard benefits:

*Note: Only applicants first eligible for Medicare Part A before 2020 may purchase Plans, C, F, and High Deductible Plan F.

Here is a visual breakdown of available plans and basic benefits:

The Medigap supplement insurance plan offers a 30-day period after you’ve received your ProCare policy where you can cancel for any reason. Simply contact one of our expert agents and we will be able to help you with the process. Any premium, less any claims paid will be refunded.

The policy will show its effective date of coverage when the policy applied for has been issued. This is different from other carriers who will only issue plan on the 1st of each month. A huge plus in our opinion.

Loss due to injury or sickness for which medical advice or treatment was recommended or given by a physician within 6 months prior to policy effective date is not covered unless the loss is incurred more than 60 days (6 months for underage 65 disability) after the effective date — with the exception of open enrollment/guaranteed issue periods. The waiting period is waived if you are replacing a Medicare Supplement policy.

UA has been providing health insurance to US residents for over 70 years. During this time, the company has established itself as a trusted provider of quality healthcare coverage at affordable rates. Here are some ways in which United American Insurance is revolutionizing health insurance in the US:

Ultimately, the UA is revolutionizing health insurance in the US by providing comprehensive coverage, telemedicine services, exceptional customer service, a network of healthcare providers, lower monthly premium rates, health and wellness programs, personalized health coaching, health savings accounts, and Medicare supplement plans. If you’re looking for quality healthcare coverage, we’re an excellent company for you.

You can discuss this with us for free, simply contact us HERE.

There are no benefits payable for: any expense which you are not legally obligated to pay; or, any services that are not medically necessary as determined by Medigap; or any portion of any expense for which Medigap makes payment; or custodial or intermediate level care, or rest cures; or any type of expense not eligible for coverage under Medigap insurance, except as provided under the Foreign Travel Emergency benefit.

United American Insurance offers a compelling suite of services through their ProCare Plans, designed with affordability and comprehensive coverage in mind. Coverage ranges from essential elements like prescription drug coverage, to dental and vision care, and extends to wellness programs tailored to various healthcare needs.

Further, their telemedicine services offer policyholders the unique benefit of receiving medical advice from anywhere, enhancing accessibility to healthcare. This emphasis on holistic wellbeing is further amplified by personalized health coaching services, designed to help members achieve their health goals with customized strategies.

Additionally, seniors find added value in Medigap Supplement Plans, which cover healthcare costs not included under Medigap. These plans exemplify United American Insurance’s commitment to revolutionizing health insurance in the US.

Selecting the most suitable United American Medicare Supplement plan can be challenging, as each plan offers different benefits that cater to various situations. The ideal plan for you may differ from what is best for your coworker, spouse, or neighbor.

Considering your financial situation and healthcare needs, the most popular Medicare Supplement plans tend to be Plan F, Plan G, Plan N, or a high-deductible plan.

While monthly premiums are an essential factor, it is crucial to look beyond them. Plans with lower premiums may have higher out-of-pocket costs, resulting in more expenses when receiving care.

To find the best United American Medicare Supplement plan for your needs, it is highly recommended to consult a licensed agent who specializes in Medicare coverage.

Although both carriers use the term “United” in its title the two companies are completely different entities. United American is owned by Globe Life and has been offering Medicare supplements for over 57 years. United Healthcare has offered Medicare supplements for 27 years. Both are fabulous companies and you would be in excellent hands with either carrier.

Of course, you can discuss this with us for free, simply contact us HERE.

There are a plethora of Medicare insurance agencies that offer similar services, so why work with Florida Healthcare Insurance? We offer superior coverage from top-rated Medicare companies (like United AmericanLife Insurance) through extensive research on what will best fit each Medicare recipient.

In addition to Medicare supplemental insurance policies, United American Insurance also provides cash cancer policies, critical illness insurance and an online portal to simplify the experience and claims process.

As policyholders and retirees we believe that United American Insurance company fulfills what we are seeking in an insurance company and Medicare Healthcare Providers. You can contact United American directly. The phone number for UA is 972-579-5086. For a quote from a broker who offers United American the phone number is 954-282-6891.

With over twenty years of experience in Health Insurance, Medicare, and Medicare Supplements, we know the right questions to ask to simplify the Medicare process and ensure you’re receiving the quality coverage you deserve — just check out the hundreds of five-star reviews!