Medigap Plans

Fill In The Gaps Of Your Original Medicare Coverage

Medigap Plans

Medigap is Medicare Supplement Insurance that we say helps “fill in the gaps” in Original Medicare. It’s sold by private companies, and pays for close to all of the costs for covered health services and supplies. A Medigap policy can help pay for some of the remaining health care costs like copayments, coinsurance, and deductibles.

Some Medigap policies cover services that Original Medicare doesn’t cover like medical care when you travel outside of the U.S. If you have Original Medicare and you purchase a Medigap policy, Medicare will pay its share of the Medicare-Approved Amount for covered health care costs and then your Medigap insurance company pays its share.

Unlike Medicare Advantage plans with a Medicare Supplement Insurance plan you can go to any doctor/hospital who takes Original Medicare.

For this reason, the team at FHI believes Medicare Supplement Insurance Plans should be your choice for your health insurance.

Download Our FREE E-Book!

Introduction to Medicare

Your Medicare Analysis from Evan & Michelle Tunis

Here are some things to know about Medigap Policies:

- You must have Original Medicare (Part A & B).

- You are responsible for paying the private insurance company a monthly premium for your Medigap policy, which is in addition to the monthly part B premium you pay to Medicare.

- A Medigap policy covers only one person. If you and your spouse both want Medigap coverage, you’ll each have to buy separate policies.

- Any standardized Medigap policy is guaranteed renewable, regardless of health condition.

- You will need a separate Prescription Drug Coverage(Part D)

Medigap Supplement Plans do not cover the following:

- Retail Prescription Drugs

- Dental Exams

- Eyeglasses

- Contacts

- Vision Exams

- Hearing Aids & Exams

- Long-term/custodial care

A Medigap plan might be right for you if:

- You don’t mind paying a higher monthly premium but paying less—or nothing—when you get medical care.

- You reside outside of Florida for more than a month each year and want to seek routine health services when you’re away.

- You don’t want to worry about staying in-network for your services to be covered, because Medigap plans don’t use networks.

- You don’t mind having a stand-alone Part D prescription drug plan.

How do you know if you need a Medicare Supplement Plan?

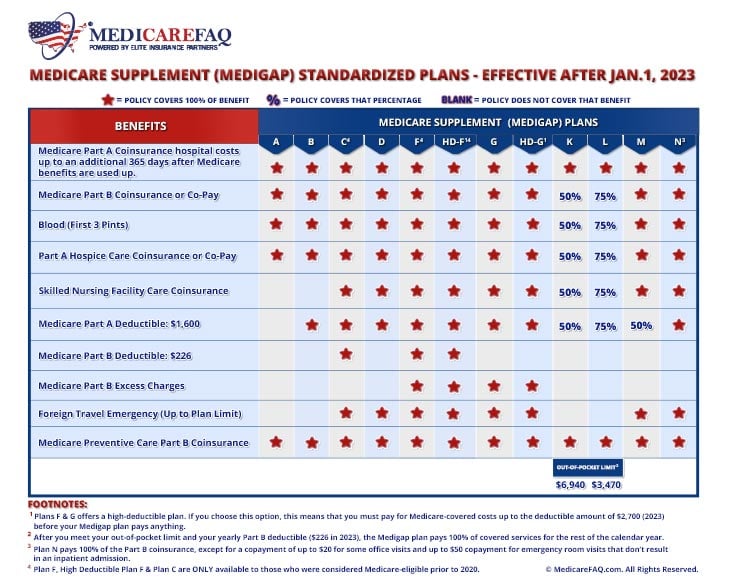

Medicare Supplement (or Medigap) insurance plans are standardized across the nation, except in Massachusetts, Minnesota, and Wisconsin. Each of the 10 plans is denoted by a letter, and the currently available plans are A, B, C, D, F, G, K, L, M, and N.

For simplicity we mainly work with Plans F, G & N.

With MediGap, you can go to any doctor or hospital nationwide who takes Medicare. There are no network restrictions. Once insured you can never be dropped due to health reasons.

Some of the gaps that Medigap plans can cover for you are:

- Hospital deductibles, copays and an extra 365 days in the hospital.

- The first 3 pints of blood as necessary in a transfusion.

- Outpatient deductibles, coinsurance, and excess charges.

- Skilled nursing coinsurance.

- Foreign travel emergency care.

Medigap Plan F

- Covers all the gaps in Medicare, including deductibles and copays

- Switching your F carrier means you will have to answer health questions (underwriting)

- The rate you pay for the same benefits can differ from Insurance Company to company, based on zip code, age, smoking, gender, and household discounts

- There is also a special version of this plan called a High Deductible Plan F. This plan often includes very, very low monthly premiums coupled with protection from high out of pocket costs, by an Annual Maximum Out of Pocket, which is set annually by the Internal Revenue Service. With this plan, you can often save a thousand or more dollars a year in those years where you do not require many expensive medical procedures while preserving your ability to see ANY doctor, ANYWHERE, as long as they accept Medicare.

However, it is important to note that Plan F is not available to individuals who are newly eligible for Medicare Supplement Plans on or after January 1, 2020. This is because the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) made changes to the availability of certain Medigap plans. Individuals who were eligible for Medicare prior to January 1, 2020, are still able to enroll in Plan F, but it is important to compare the coverage and costs of other Medicare Supplement coverage to determine which plan is the best fit for their healthcare needs and budget.

Medicare Plan G

For those eligible for Medicare after January 1, 2020 plan G is likely the best Medicare Supplement available to you. Plan G is a popular choice among seniors as it provides comprehensive coverage with minimal out-of-pocket costs.

Plan G covers the majority of healthcare costs, including hospital stays, doctor visits, skilled nursing facility care, hospice care, and certain medical equipment and supplies. It also covers excess charges for medical services that exceed the Medicare-approved amount. The only out-of-pocket costs for Medigap Plan G are the Medicare Part B deductible and any excess charges that exceed the Medicare-approved amount. This makes Medigap Plan G an attractive option for those who want comprehensive coverage without worrying about unexpected healthcare costs.

One of the benefits of Plan G is that it provides more coverage than some of the other Medigap plans. For example, it covers the Part B deductible, which is a cost that other plans, such as Plan N, do not cover. Plan G also covers excess charges, which can be significant for those who receive medical services from providers who charge more than the Medicare-approved amount.

In addition, Plan G has no copayments or coinsurance for doctor visits or hospital stays, making it a straightforward and easy-to-understand plan. However, it is important to note that Plan G may have higher monthly premiums than other Medigap plans, so it is important to compare plans and costs before making a decision.

Private insurance companies such as AARP United Healthcare, United American, and Aetna Insurance company all offer Plan G Medicare supplement plans.

Medicare Plan N

PLAN N is used primarily for price savings!

It is considered statistically the most stable on prices across the board. However, there are some differences in Plan N that need to be understood:

The biggest thing with Plan N is it does not cover Excess charges. Excess charges are fees above the Medicare-approved payment schedule. A doctor has the option to charge up to 15% ABOVE the Medicare-approved payment schedule. These excess charges are passed on to the patient and billed directly to you after the fact.

Currently these states prohibit excess charges: Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island and Vermont.

- Plan covers 100% of the hospitalizations associated with Medicare Part A and covers the 20% completely. Similar to Plan G it does not cover the Part B deductible.

- Copay for a primary care/specialist of up to $20.

- Emergency Room copay of $50.

One of the benefits of Plan N is its lower monthly premiums compared to some of the other Medigap plans, such as Plan F or Plan G. This makes it an attractive option for those who want comprehensive Medicare Supplement plan coverage but have a limited budget.

Additionally, Plan N includes coverage for emergency medical care received while traveling outside of the United States, which is not covered by Original Medicare. However, it is important to note that Plan N may have higher out-of-pocket costs than some of the other Medigap plans, such as Plan G or Plan F. Beneficiaries may need to pay a copayment for some services, which can add up over time, especially if they require frequent medical care. Therefore, it is important to compare plans and costs before making a decision to ensure that Plan N is the right fit for individual healthcare needs and financial situation. With Plan N you would still need need to meet the Part B Medicare deductibles of $226 for 2023.

Get a FREE Insurance Quote!

Florida Health Insurance Client Testimonials

Florida Health Insurance Insurance Partners