Medicare Part B

Learn More About Medicare Part B in South Florida

Medicare Part B

Medicare Part B is different from Part A in that it provides medicare benefits like medically critical supplies and services required for the treatment or diagnosis of your health state, including outpatient services provided in a hospital, clinic, doctor’s office, or any health facility.

While Medicare Part A covers hospital insurance, Medicare Part B provides additional Medicare benefits medical insurance in part A might not cover. Part B Medicare coverage also helps cover preventive services to help detect illness or avoid them at an earlier stage. Here are some of the examples of outpatient medical coverage that Part B offers:

- Doctor office visits

- Diagnostic imaging and lab testing

- Ambulance rides and surgeries

- Chemotherapy and radiation

- Preventive care (screenings, shots or vaccines, and yearly “wellness” visits)

- Extensive dialysis care

How do I know if I’m eligible for Medicare Part B?

If you are age 65 and above, you’re eligible for Part B Medicare coverage as well, however, there is a monthly premium for Part B. Medicare beneficiaries don’t have a monthly premium for part A. This monthly premium provides for your outpatient benefits like doctor visits, lab work, surgery fees, and more. Also, note that if you are taking Social Security early, you will automatically be enrolled in Medicare Part B unless you specifically ask Social Security not to enroll you.

Part B is not to be confused with Original Medicare or Medicare Advantage plans. Original Medicare is Part A & Part B, and Medicare Advantage plans are considered supplemental medical health insurance.

What if I’m still working?

The majority of people turning 65 still receive health insurance through their employer. If this is the case, your Medicare health insurance enrollment into Part B can be delayed with their group health insurance being primary, and without receiving a late penalty, as long as the employer has more than 20 employees. If you work for a smaller company, you must have both Medicare Part A and Part B to be covered by your employee group health plan.

We suggest you giving us a call if you decide to delay your enrollment into Medicare Part B. We are able to help explain your options like special election periods.

How much is the Medicare Part B late enrollment penalty?

- You’ll pay an extra 10% for each year you were able to signed up for Part B but did not.

- The penalty is added to your monthly Part B premium. You could also pay a higher premium depending on your income.

- The penalty will occur for as long as you have Part B — this is not a one-time late fee.

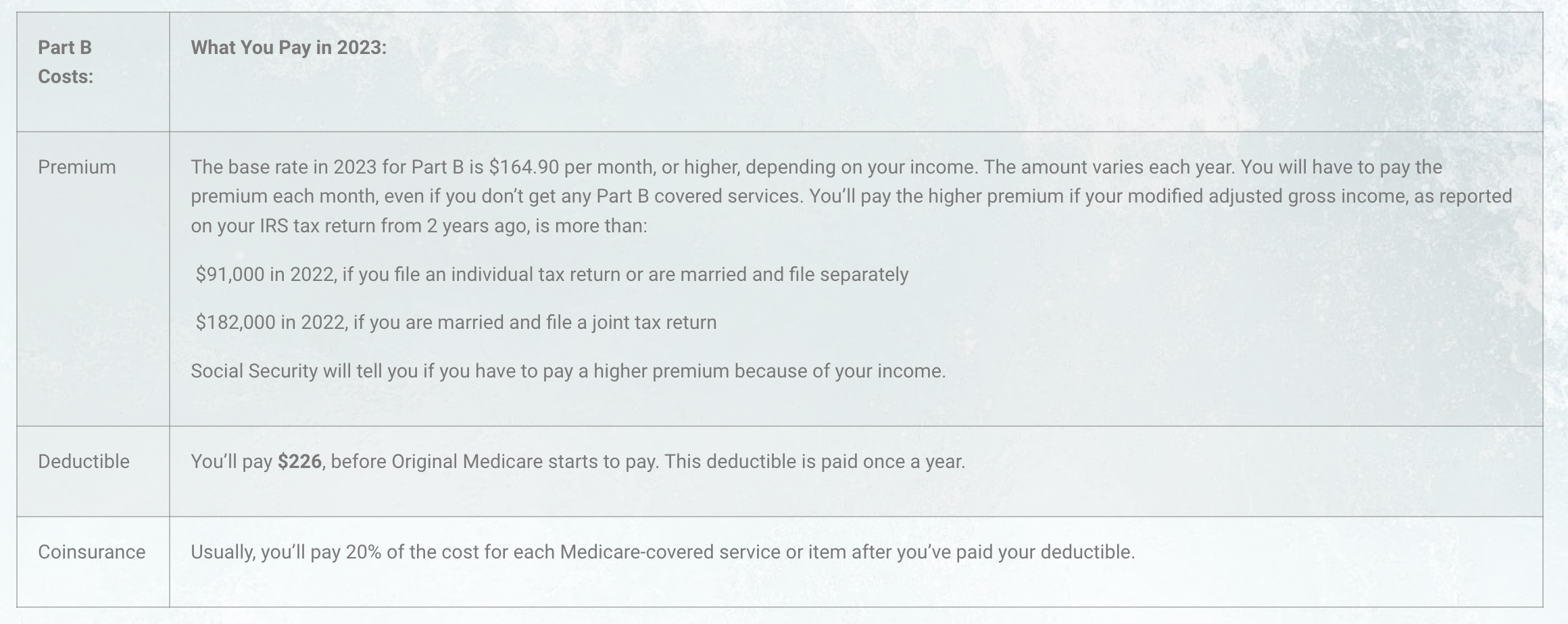

Let’s take a look at a snap shot of the Part B costs:

|

Part B Costs: |

What You Pay in 2023: |

|

Premium |

The base rate in 2023 for Part B is $164.90 per month, or higher, depending on your income. The amount varies each year. You will have to pay the premium each month, even if you don’t get any Part B covered services. You’ll pay the higher premium if your modified adjusted gross income, as reported on your IRS tax return from 2 years ago, is more than: $91,000 in 2022, if you file an individual tax return or are married and file separately $182,000 in 2022, if you are married and file a joint tax return Social Security will tell you if you have to pay a higher premium because of your income. |

|

Deductible |

You’ll pay $226, before Original Medicare starts to pay. This deductible is paid once a year. |

|

Coinsurance |

Usually, you’ll pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible. |

Yikes, you just noticed that you’re responsible for 20% of the costs! Don’t stress! We take pride in finding you the specific plan that covers the remaining 20% at little to zero cost to you!

What are the benefits to Original Medicare?

It may seem strange to automatically get enrolled in a healthcare plan without asking for it, but it can be a positive in many ways. By working with Florida Healthcare Insurance, we will make sure you don’t have to miss your window to gain access. We will review your current health insurance and revise the coverage to be more in sync with your current specific healthcare needs.

How does Medicare Advantage and Medicare Supplement Plans work?

In addition to Original Medicare (Part A and Part B), there are two other options for Medicare in Florida: Medicare Advantage plans (Part C) and Medicare Supplement plans.

Medicare Advantage plans are offered by private insurance companies and provide all of the benefits of Original Medicare (Part A and Part B) as well as additional benefits like prescription drug coverage, routine vision and dental care, and often routine hearing exams. Some Medicare Advantage plans also offer extra benefits like gym memberships, transportation services, and home-delivered meals.

Medicare Advantage plans usually have a network of providers that you must use in order to receive full benefits. This network is usually comprised of doctors, hospitals, and other healthcare providers who have agreed to provide care to Medicare Advantage plan members. If you receive care outside of this network, you may be responsible for a larger portion of the cost.

Medicare Supplement plans, also known as Medigap plans, are designed to help cover the out-of-pocket costs that Original Medicare does not cover. These plans are offered by private insurance companies and are standardized by the federal government, meaning that the benefits offered by a Medicare Supplement plan are the same regardless of which insurance company you purchase it from.

There are 10 different Medicare Supplement plans available in Florida, each with a different set of benefits. Some of the most common benefits offered by these plans include coverage for Medicare Part A and B deductibles, coinsurance, and copayments, as well as coverage for the cost of medical services received while traveling outside of the United States. You will need to purchase a separate Medicare prescription drug coverage(Part D) with a Medicare Supplement Insurance plan.

Florida Medicare beneficiaries will need prescription drug plans.

It’s important to compare the benefits and costs of Medicare Advantage and Medicare Supplement plans in order to determine which option is best for your individual needs. Factors like monthly premium, copays, deductibles, and network restrictions should all be considered when making your decision about Medicare supplement insurance. Additionally, it’s a good idea to periodically review your coverage options and make any necessary changes to ensure that you’re getting the coverage that you need.

If you’re interested in Part B Medical insurance or would like to know what your Medicare insurance plans options are, give us a call. Our expert agents are ready and happy to help you determine your Medicare resources and any benefits you may be qualified for. Reach out to Evan Tunis at (954) 282-6891.

Download Our FREE E-Book!

Introduction to Medicare

Your Medicare Analysis from Evan & Michelle Tunis

How much does Medicare Part B cost?

The Medicare program may be confusing and complex to fully grasp. It’s difficult for individuals to know whether or not they have selected the right amount of coverage for their needs. It’s vital to be properly insured to protect both your health and your finances, so your Medicare coverage shouldn’t be left to chance. Pass the task of finding your Medicare plan to us! We know where to look and what to look for in optimal coverage. After learning about your situation and unique needs, we won’t rest until we’ve located the right plan for you.

What is Medicare?

Medicare is a federal health insurance program that has been providing health coverage for millions of Americans since it was first introduced in 1965. The program is administered by the Centers for Medicare & Medicaid Services (CMS) and provides health insurance to people over the age of 65, those with certain disabilities, and people with end-stage renal disease (ESRD) and amyotrophic lateral sclerosis (ALS).

Medicare has several parts, including a Medicare Advantage plan, prescription drug coverage, and parts A & B. Each part provides different types of coverage. Eligibility for each part varies. It’s important to understand the different parts of Medicare to make the best decisions about your healthcare coverage. Today we’re looking into Medicare Part B and what it can potentially cost.

What is Medicare Part B and what does it cover?

Medicare Part B provides coverage for outpatient benefits such as doctor visits, lab work, and surgery fees. You must pay a monthly premium for Medicare Part B, and you can enroll either online, by phone, or at a local Social Security office. Turning 65 and still have group health plan or insurance through an employer? You can delay enrollment into Medicare Part B in favor of your group health insurance without fearing a late penalty.

Medicare Part B helps cover medical services like doctor visits, outpatient care, and other medical services that Part A doesn’t cover. It’s important to remember that ePart B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem.

When Can I Enroll in Medicare Part B?

Initial enrollment periods for Medicare (Part A and/or B) happens automatically if you are turning 65 and already receiving Social Security or will start collecting retirement at age 65.

You will need to sign up for Medicare Part B at the time that you apply for retirement benefits, and Medicare Part A enrollment occurs automatically if you are eligible for Social Security retirement. A Medicare card will be mailed out about three months before your 65th birthday.

If you work for a smaller company, you must have both Medicare Part A and Part B to be covered by your company plan. You might need to evaluate whether the company plan makes sense for you or not. If you delay enrollment into Part B, consult with a local insurance agent who specializes in Medicare.

Once you are enrolled in Medicare Part A & Medicare Part B you can enroll in Medicare benefits such as Medicare, Advantage plan and Medigap plans. What is your monthly premium? The monthly part B premium is currently $146.90 a month. If you are collecting social security, you will be automatically enrolled in Medicare Part A and Medicare Part B.

How does late enrollment affect Part B premiums?

If you miss your initial enrollment for whatever reason, you can sign up for Medicare Part A and/or Part B during the General Enrollment Period that runs from January 1 through March 31 of every year. You may have to pay a late enrollment penalty for both Part A and Part B if did not sign up when you were first eligible. You can also make changes to your coverage during general enrollment.

If you missed the Annual Election Period for Medicare and need to make changes to your policy, you can do this during the Medicare Enrollment Period, from January 1st to March 31st each year. If you switch to Original medicare during this period, you will have to wait until March 31 to enroll in a Medicare Part D prescription drug plan.

Medicare allows changes outside the standard enrollment periods in specific situations that are often out of the beneficiary’s control, such as Medicare ending its contract with your plan, through Special Election Periods (SEPs). Other examples of these situations include, but are not limited to, the following:

-

- Moving out of your plan’s service area.

-

- Receiving both Medicare and Medicaid benefits.

-

- Qualifying for Extra Help.

-

- Living in, moving to, or moving from an institution such as a long-term care hospital or skilled nursing facility.

How much does Medicare Part B Cost?

The Medicare monthly premium for Part B is currently $146.90 a month. If you are collecting social security, you will be automatically enrolled in Medicare Part A and Medicare Part B.

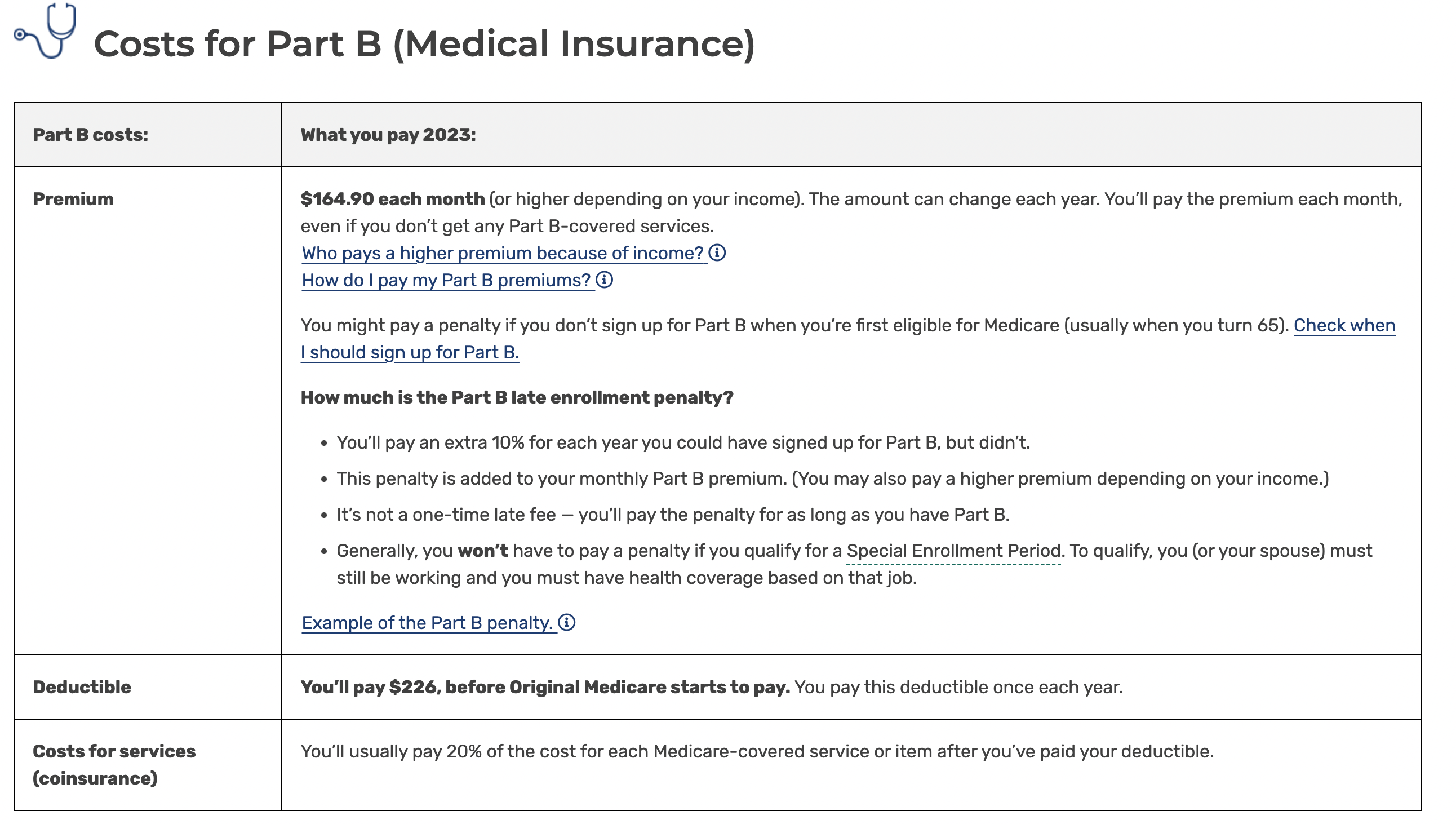

If you have Part B, you pay a Part B premium each month. Most people will pay the standard premium amount. Social Security will contact some people who have to pay more depending on their income. If you don’t sign up for Part B when you are first eligible, you may have to pay a late enrollment penalty.

How much is the Medicare Part B late enrollment penalty?

-

- You’ll pay an extra 10% for each year you were able to signed up for Part B but did not.

-

- The penalty is added to your monthly Part B premium. You could also pay a higher premium depending on your income.

-

- The penalty will occur for as long as you have Part B — this is not a one-time late fee.

How does my income affect my Part B premium?

If you have Part B, you pay a Part B premium each month. Most people will pay the standard premium amount. Social Security will contact some people who have to pay more depending on their income. If you don’t sign up for Part B when you are first eligible, you may have to pay a late enrollment penalty.

How much does Part B cost?

What does ‘accepting assignment’ mean?

You can get the lowest cost if your doctor or other health care provider accepts the Medicare-approved amount as full payment for a covered service. This is called “accepting assignment”. If a provider the Medicare approved amount, it’s for all Medicare-covered Part A and Part B services.

Using a provider that accepts assignment

Most doctors, providers, and suppliers accept assignment, but always check to make sure that yours do. If your doctor, provider, or supplier accepts assignment:

-

- Your out-of-pocket costs may be less.

-

- They agree to charge you only the Medicare deductible and coinsurance amount, and usually wait for Medicare to pay its share before asking you to pay your share.

-

- They have to submit your claim directly to Medicare and can’t charge you for submitting the claim.

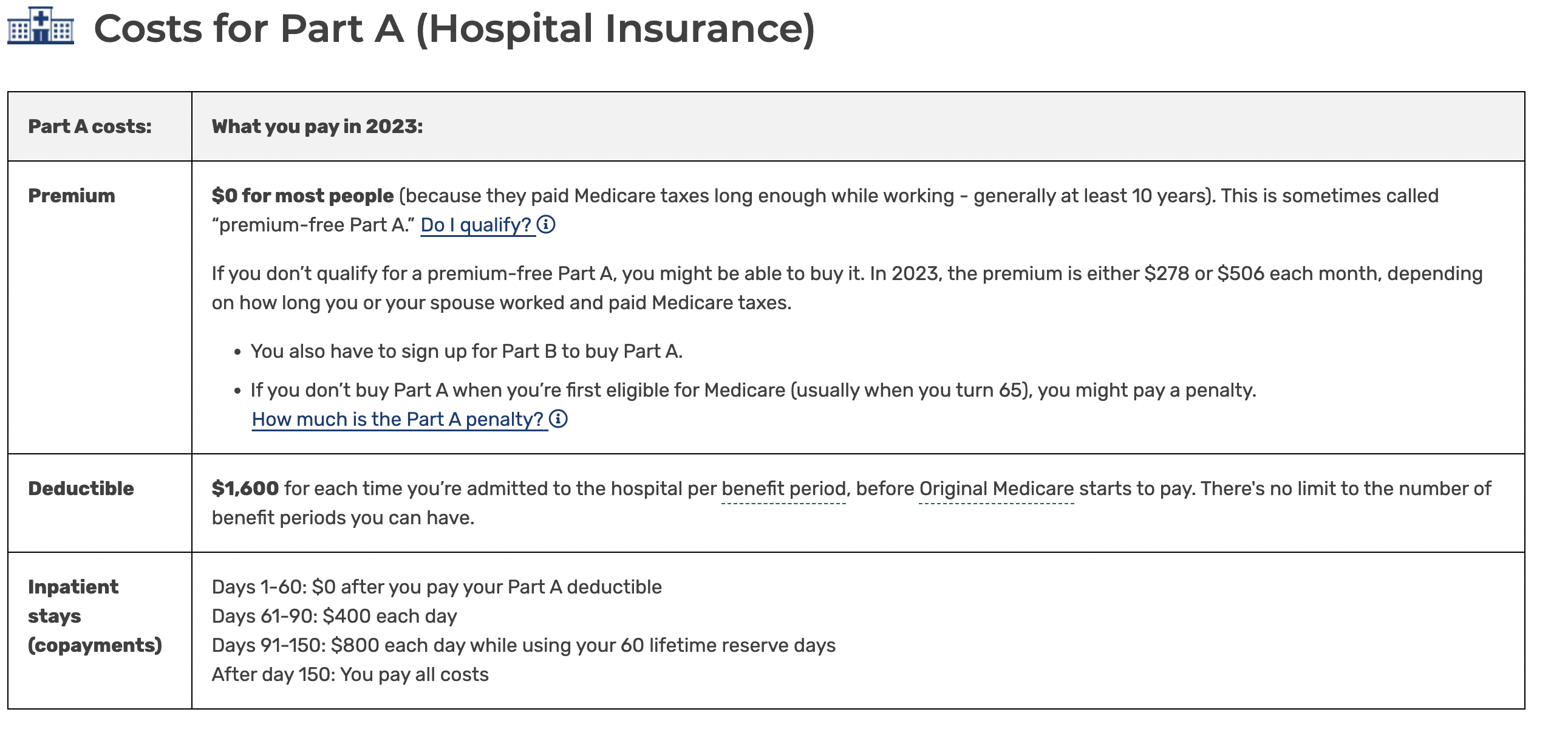

What are Original Medicare premiums in 2023?

Generally, you pay monthly premiums for Medicare coverage and part of the costs each time you get a covered service. There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medicare Supplement Insurance (Medigap) policy, or you join a Medicare Advantage Plan.

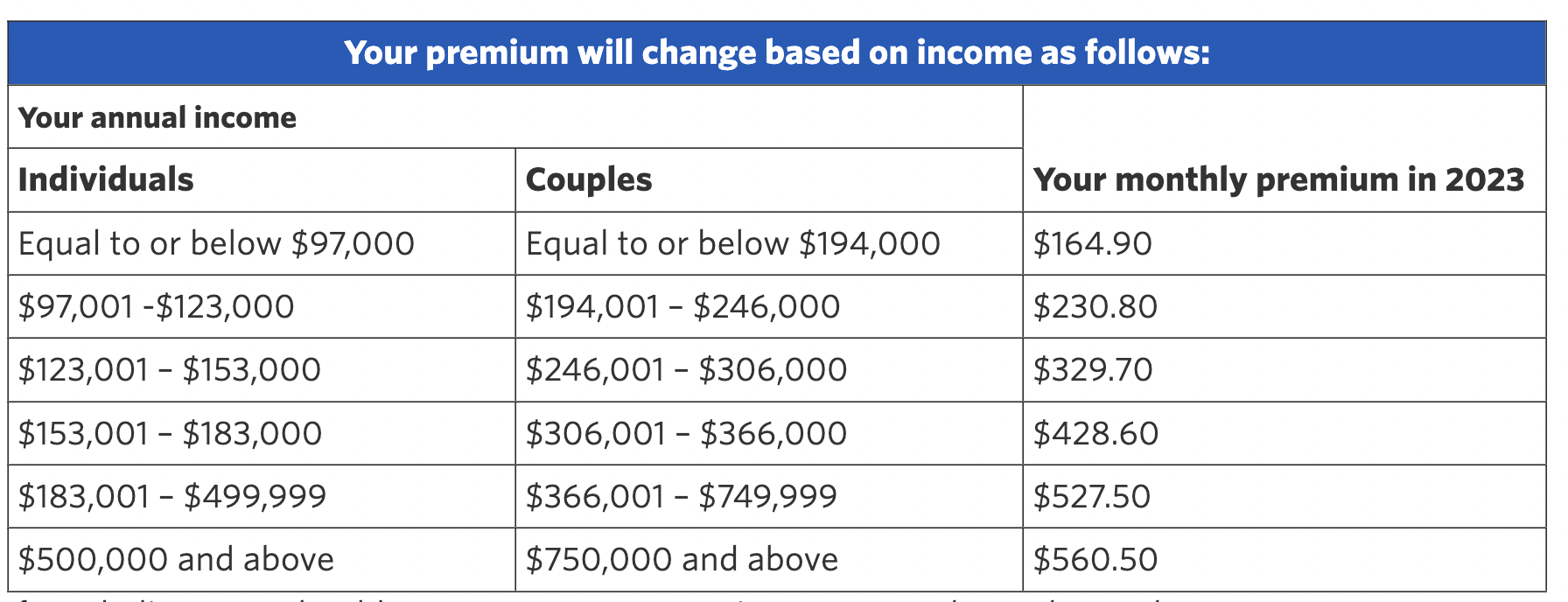

Part B surcharges for high-income earners

The Medicare Income-Related Monthly Adjustment Amount (IRMAA) is an amount you may pay in addition to your Part B or Part D premium if your income is above a certain level. The Social Security Administration (SSA) sets four income brackets that determine your (or you and your spouse’s) IRMAA. SSA determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior, meaning two years before the year that you start paying IRMAA. The income that counts is the adjusted gross income you reported plus other forms of tax-exempt income.

If you are expected to pay IRMAA, SSA will notify you that you have a higher Part B premium.

If you believe you should not pay IRMAA, your circumstances have changed, or your IRMAA was miscalculated, you have the right to request that SSA lower or eliminate your premium increase. You will have to submit evidence whether you are appealing SSA’s original determination or requesting a new determination.

Ready for more information about your upcoming Medicare policy?

if you’re looking for help with your Medicare coverage, Florida Healthcare Insurance is a great choice. With our expertise, personalized service, choice of plans, convenience, and commitment to your peace of mind, we can help you find the right Medicare plan for you. Contact us today to learn more about how we can assist you with your Medicare needs.

Don’t delay! Contact us by phone at (954) 282-6891, or by requesting a quote in the “Get A Quote” button on the top right-hand corner.

Our experts will take the time to explain all of your insurance options to make sure you clearly understand the plans that are best for you. Our goal is to ensure you get the ideal coverage for your specific needs, and there are absolutely no fees whatsoever to work with us.

Get a FREE Insurance Quote!

Florida Health Insurance Client Testimonials

Florida Health Insurance Insurance Partners