As you or a loved one approaches Medicare eligibility, the world of healthcare insurance can be complex and overwhelming. Thankfully, in Florida, there are a variety of options available, including Original Medicare, Medicare Advantage, and Medicare supplements. As an experienced insurance agency, Florida Healthcare Insurance is here to help you navigate the various Medicare Insurance plans and find the right coverage for your individual needs.

Original Medicare

When you first become eligible for Medicare, typically at age 65, you have the option to enroll in Original Medicare, which includes Part A (hospital insurance) and Part B (medical insurance). Original Medicare is a federal program that covers hospital stays, doctor visits, and other medical services. It does not cover all your Medicare benefits.

Additional Medicare coverage for all of your healthcare costs, which include deductibles, coinsurance, and copayments. This is why it’s important to consider supplemental coverage, like Medicare supplements or Medicare Advantage plans, to help cover these costs.

Medicare Supplement Insurance

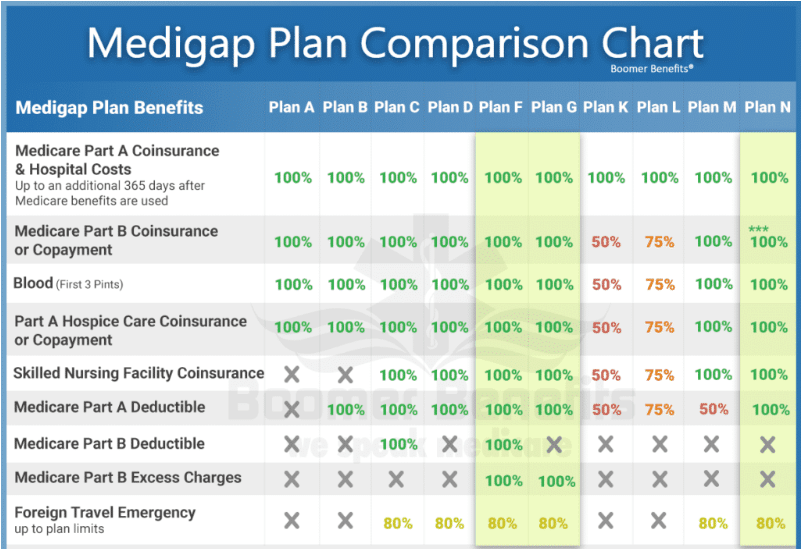

Medicare supplements, also known as Medigap plans, are designed to help cover the gaps left by Original Medicare. These plans are offered by private health insurance companies and are standardized by the federal government, meaning that the benefits offered by each plan are the same across various companies. The health plans have a different cost depending on location and age.

There are 10 different types of Medicare supplements available, each offering different levels of coverage. It’s important to choose the plan that best fits your needs and budget. With a Medigap plan, you have your choice of doctors/providers.

Our team at Florida Healthcare Insurance can help you compare the different Medicare plans and make an informed decision. Our team considers Plan G to be the best coverage for those of Medicare age.

Medicare Advantage

Another option for Medicare coverage is Medicare Advantage. These plans, also known as Medicare Part C, are offered by private insurance companies approved by Medicare. A Medicare Advantage plan provides the same coverage as Original Medicare, but often includes additional benefits like dental, vision, and hearing coverage. Some plans may also offer prescription drug coverage.

An Advantage plans work differently than Original Medicare. When you enroll in a Medicare Advantage plan, you will still pay your Part B premium, but you will receive your healthcare benefits through the private insurance company. These plans often have networks of doctors and hospitals that you must use to receive coverage. Our team can help you compare different health insurance plans including a Medicare Advantage plan and find the one that best fits your needs.

Enrollment

It’s important to enroll in the right Medicare plan for your individual needs. If you miss your initial enrollment period, you may be subject to penalties and may have to wait until the next enrollment period to enroll. Our team can help you understand your enrollment options and make sure you enroll in the right plan at the right time.

Special Enrollment Period

In some cases, you may be eligible for a Special Enrollment Period (SEP) outside of the initial enrollment period. For example, if you move out of your county, lose group coverage, or have end-stage renal disease, you may qualify for a SEP. Our team can help you understand if you qualify for a SEP and help you enroll in the right plan. Also, certain health care can be provided by Medicaid services. For questions on a SEP please contact the social security administration.

Healthcare Costs

We understand that healthcare costs can be a major concern, especially for those on a fixed income. It’s not a secret that health insurance costs keep increasing. When considering the costs associated with Medicare supplements and Medicare Advantage plans, it’s important to weigh the benefits and decide which plan is the right fit for you.

Medicare supplements can help cover the deductibles, coinsurance, and copayments not covered by Original Medicare, while Medicare Advantage plans may offer additional benefits like dental, vision, and hearing benefits. Our team can help you compare the costs associated with different health insurance plans and make sure you choose the right plan for your individual needs and budget. When you get Medicare Insurance it takes the place of your existing health insurance plan.

Extra Help

If you have limited income and resources, you may qualify for Extra Help, which is a program that helps pay for the costs associated with Medicare prescription drug coverage (Part D). This program is offered through the Social Security Administration and can help reduce the cost of prescription drugs for those who qualify.

Group Insurance

If you are still working and have group insurance, it’s important to understand how your insurance will work with Medicare. Depending on the size of your employer, you may be required to enroll in Medicare when you turn 65, or you may be able to delay enrollment. Our team can help you understand how your group plan works with Medicare and Medicare Supplement plan to make sure you have the right benefits.

Insurance Plans

At Florida Healthcare Insurance, we work with various insurance Medicare Supplement companies, including United Healthcare, United American, Aetna, Cigna, and Florida Blue. Most insurance companies offer a variety of Medicare plans, including Medicare Advantage, Medicare supplements, Life Insurance, and Medicare prescription drug coverage (Part D). Our team can help you compare the insurance plans offered by United Healthcare and others and help you make an informed decision.

Finding the Best Coverage

At Florida Healthcare Insurance, our mission is to help you find the right Medicare plan for your individual needs. We understand that healthcare insurance can be complex and overwhelming, which is why we offer personalized service to help you make an informed decision. We’ll take the time to listen to your individual needs and concerns and help you find the right plan for you and your family.

When it comes to Medicare insurance, premiums can be a significant concern for many beneficiaries. The cost of your premium will depend on the type of plan you choose and the coverage it provides. At Florida Healthcare Insurance, we work with various insurance companies to offer our clients a range of plan options at different price points. Our goal is to help our clients find the right plan that fits their individual needs and budget. We understand that every client is unique, and we take the time to get to know our clients so we can recommend the right plan for them. Our experienced representatives will work with you to evaluate your options and ensure that you select the right plan for your needs.

Contact us today at our phone number 954-282-6891 to speak with one of our licensed brokers about finding the Medicare solution for you today.